An individual loan (Personal Loan) is a sort of unbound credit that is reached out by

Financial Institutions. Being named unbound, personal loan don't

convey the necessity of security. These advances are given to

candidates exclusively on their record of loan repayment and capacity

to reimburse the credit from their present individual pay.

Budgetary Institution financing costs on close to

home credits aren't normally fixed. The loan cost charged contrasts

from Financial Institutions to Financial Institutions.

Notwithstanding, as an unpleasant guide, financing costs on an

individual credit run from 11-37% per annul. Factor in the intrigue

installments alongside reimbursement of capital inside the concluded

residency to find out a decent advance add up to request. Here, we

have accumulated a little rundown of tips that will guarantee that

your own advance application gets affirmed with no glitches.

Meet

the Eligibility Criteria:

Obviously, it's implied

that Financial Institutions won't process your own advance

application on the off chance that you don't meet their qualification

criteria. A ton of candidates don't take a gander at the

qualification criteria and apply despite the fact that they are not

qualified for the credit. This makes Financial Institutions reject

such application. When in doubt of hand, you ought to check the

qualification criteria of each Financial Institution you're willing

to apply to, and apply just on the off chance that you meet each and

every basis. For the most part, the base age for applying for a

credit is 21 years, and the greatest age is 60 years. Guarantee that

you meet their qualification criteria is each viewpoint, for example,

archives, pay declarations, assessment forms, credit reports, and so

on.

Have

a Good Credit Score:

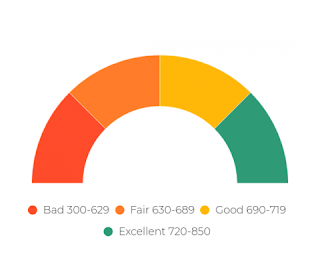

Credit ratings assume a

significant job in Financial Institutions choosing whether or not to

favor your credit application. Financial assessments are determined

by your obligation to credit proportion, and how reliably you've

reimbursed any past advances that you have taken. The greater

reliability you have on your credit installments, the higher your

credit assessment will be. The score ranges from 350-900, and

anything over 700 is viewed as really great. Notwithstanding, in the

event that you don't have a decent financial assessment, it is better

that you don't send your application straight away, yet find a way to

improve your credit rating.

Don’t

Apply for a New Loan While Repaying a Previous One:

When in doubt, attempt

to keep up a hole of a half year between progressive credits.

Additionally, don't have any significant bearing for an personal loan when you have another advance in your name. The Financial

Institutions will consider this to be an additional weight on your

accounts, and most likely reject your application. Money related

Institutions consistently perceive how attainable it is for you to

reimburse their credit – this is done to relieve dangers for the

Financial Institution.

Be

Reasonable When Deciding Your Loan Amount:

Budgetary Institutions

check your reimbursement capacity before choosing whether or not to

favor your application. Monetary Institutions allude to your present

pay to learn your reimbursement capacity. On the off chance that you

request a sum that is ludicrously high, odds are your credit

application will be dismissed by the Financial Institution. Check on

the off chance that you can reimburse the sum serenely in the chose

residency, and at exactly that point request that sum.

Don’t

Send Out Multiple Loan Applications:

Something that

candidates do that puts off Financial Institutions is applying to

various Financial Institutions. Many individuals feel that applying

to numerous Financial Institutions expands their odds of endorsement.

Be that as it may, this isn't really valid. Truth be told, it is the

specific inverse. Apply to just a single Financial Institution at

once; supposing that there are numerous applications you've conveyed,

Financial Institutions see that the odds of you taking an advance

from that specific Financial Institution are lesser. Thus, however

much as could reasonably be expected, limit your advance

applications.

Conclusion:

Your advance

application ought to showcase itself, and to do that you have to

guarantee you round it out consummately according to the desires for

the Financial Institution. You should have the option to demonstrate

your reimbursement capacity and have a decent credit assessment.

Apply to Financial Institutions calmly, and obviously, search for an

arrangement with a low-loan fee.

Apply for personal loan online or check personal loan eligibility

This comment has been removed by a blog administrator.

ReplyDelete